tax sheltered annuity vs 401k

However TSA plans are reserved for employees of tax-exempt organizations and self-employed people while 401k plans are open to any private-sector employee whose employer offers a. A Vs 401k.

The Tax Sheltered Annuity Tsa 403 B Plan

Furthermore 401 ks allow borrowing of funds while annuities dont.

. TSA plans are reserved for employees of tax. Which Is Best For Retirement. The gains you experience in a Roth.

Tax-sheltered annuities are similar to 401k plans in that both plans encourage individual savings by allowing for pretax contributions to a retirement plan on a tax-deferred basis. Cross Border Wealth is a US-based Registered Investment Advisory firm. Both annuities and 401ks provide a tax-sheltered way to save for retirement.

401k A 401k is a tax-deferred retirement account you can often get through your employer. Qualified plans allowed employees to contribute up to 19500 in 2021. You will not owe income taxes on the investment returns of a 401k or annuity until you withdraw from the plan.

Its similar to a 401k plan maintained by a for-profit entity. Ad Your comprehensive guide to 401k management for non-US residents is here. Tax sheltered annuity plans are considered supplemental retirement accounts because they are not intended to replace other more primary retirement plans.

A tax-sheltered annuity is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement income. You contribute money to it customarily as a regular deduction from your paycheck. One similarity between the two instruments is the nature of tax deferral wherein the savings are exempt from tax and you have to pay tax on the benefits upon your retirement like any other.

Notably 401 k plans are available to any eligible private sector employee who works for a company with a plan. A 403b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. 403 b plans are offered to employees of non-profit organizations and government.

Cross Border Wealth is a US-based Registered Investment Advisory firm. You dont have to pay taxes on earnings contributed to a. Annuity is a life-insurance policy which is setup to work as the investment plan where a contract is made between a participant and an insurance company in which participant give money to insurance company and in return insurance company make payments as per the terms and condition whereas 401k is a popular tax-deferred retirement.

Just as with a 401k plan a 403b plan lets employees defer some of their salary into individual accounts. The most glaring difference is the fact that you choose annuity as a financial product from an insurance company while 401k is a retirement plan offered by your employer. 403 b plans are exempt from nondiscrimination testing whereas 401 k plans are not.

Tax-sheltered annuities are designed to provide consistent payouts over time and act as a reliable source of income in retirement. Ad Your comprehensive guide to 401k management for non-US residents is here. Difference Between Annuity and 401k.

The gains you enjoy in both traditional 401 ks and annuities are tax-deferred and youll only pay taxes when you begin taking distributions. However the amount that can be sheltered in an annuity account for retirement purposes is capped. Your tax-advantaged investment comes at a cost since both annuities and 401k accounts typically have higher management costs than investing directly in stocks or funds.

From there the two plans diverge. 403 tax-sheltered annuity plans Certain grandfathered 401 plans adopted by a governmental entity before May 6 1986. A 401 k is a qualified plan which means that your company gets a tax benefit for contributing money to the account on your behalf and you can contribute part of your paycheck to the plan before the IRS taxes the funds.

The 401k is pre-taxed before the contributions are made so it is not like. In addition tax-sheltered annuities offer lifetime catch-up for participants. However the 403 b is in use by a specific set of employers and is.

But there is a catch. 401 k plans are offered by for-profit companies to eligible employees who contribute pre or post-tax money through payroll deduction. However theres a limit to how much you can contribute to a 401k while annuities offer unlimited contributions.

A Tax Sheltered Annuity also called a TSA or 403b is a retirement plan offered by public schools and certain 501c3 tax-exempt nonprofit organizations. These plans do resemble one another. Both the 403 b and 401 k are tax shelters helping employees save money for retirement while reducing some of that pre-tax income.

Both annuities and 401 k plans are usually tied to an individuals tax bracket. A TSA also offers a catch-up provision for participants 50 and older which amounts to 6500 in 2021 and 6500 in 2022. The main difference between both types of plans is.

Annuities often have lower returns as well as high costs. 401k plans are offered by private for-profit companies and the 403b plans are available only to nonprofit organizations and government. But this will increase to 20500 in 2022 matching the contribution limits of 401 k plans.

Both 401k and 403b have taken the name after sections of the tax code they are qualified tax-advantaged retirement vehicles offered to employees by employers.

Taxsheltered Annuity Plans Also Known As 403b Plans

Annuity Lifetime Income Later Safety Guarantees Magi

403 B Vs 401 K Which Is The Better Plan Pros And Cons

Annuity Vs 401 K What S The Difference Forbes Advisor

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Annuity Vs 401k Comparing The Risk And Benefits

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Massmutual What S In A Name A Retirement Plan Comparison

A Proven Plan For Financial Success Ramseysolutions Com Budgeting Money Financial Peace Money Quotes

The Hierarchy Of Tax Preferenced Savings Vehicles

Taxsheltered Annuity Plans Also Known As 403b Plans

Withdrawing Money From An Annuity How To Avoid Penalties

What Is A Tax Deferred Annuity Due

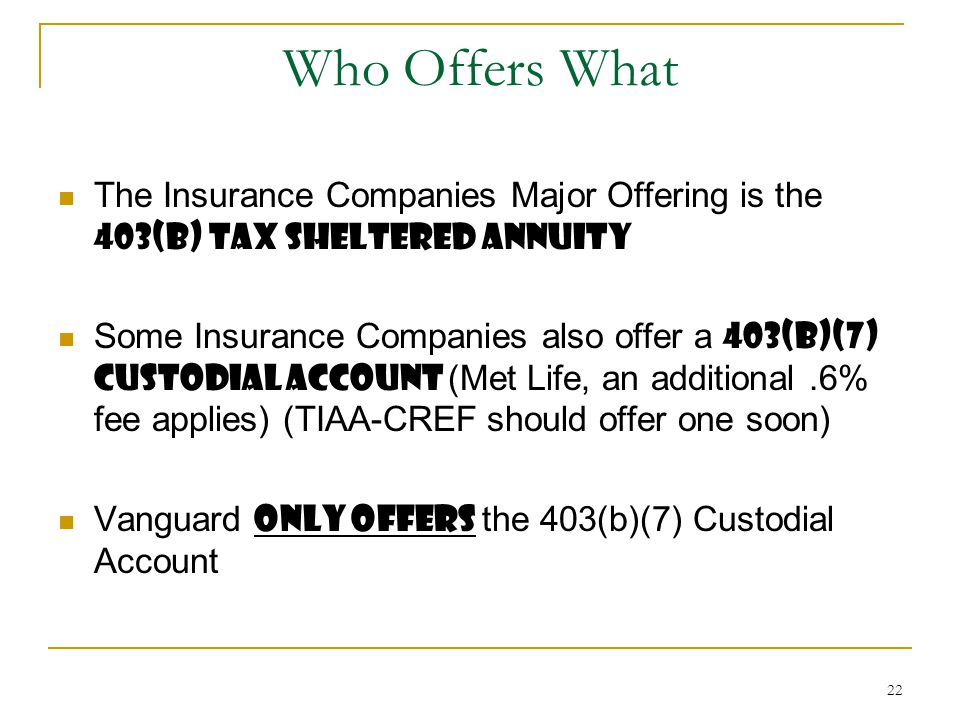

The 403 B The 403 B What Is It What S Wrong With It Ppt Video Online Download

Taxation Of Annuities Ameriprise Financial

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)